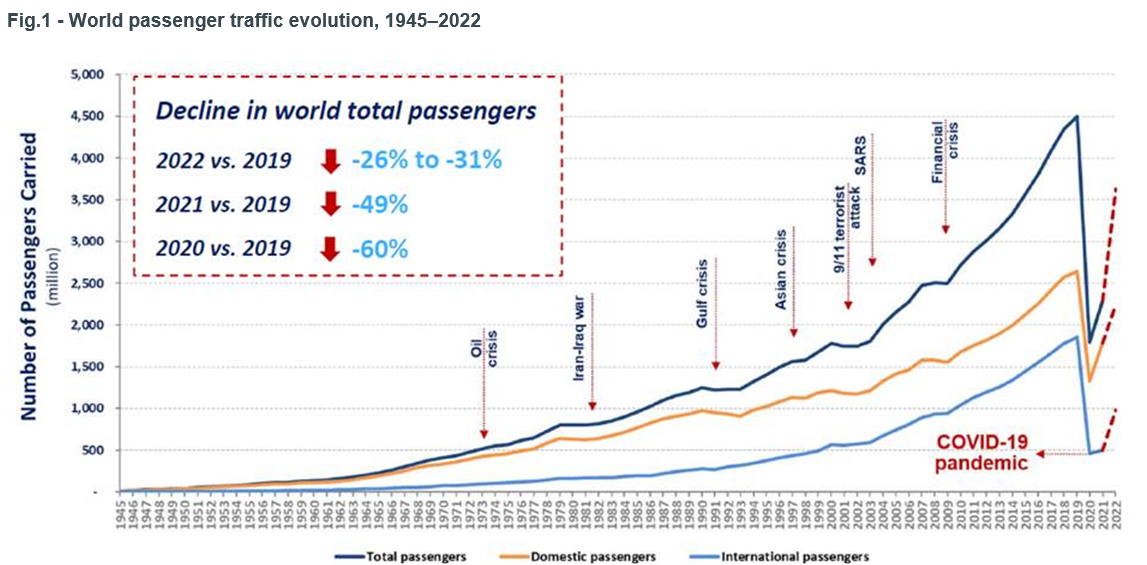

Global passenger traffic recovered modestly in 2021, with the latest ICAO economic impact analysis of COVID-19 on civil aviation revealing that the number of passengers worldwide was 2.3 billion or 49 percent below pre-pandemic (2019) levels, up from the 60 percent drop seen in 2020. Global seat capacity offered by airlines improved by 20 percent during the same period, exceeding the growth in passenger demand. The overall passenger load factor in 2021 stood at 68 percent, compared to 82 percent in 2019, and airlines worldwide incurred losses of $324 billion following $372 billion in 2020 (see Fig.1).

Continuing efforts by States to implement WHO and ICAO recommendations, including those issued by the ICAO Council’s Aviation Recovery Task Force (CART), and adopted in the Ministerial Declaration at ICAO’s High-level Conference on COVID-19, are helping to eliminate travel restrictions disproportionate to public health risks, and to lessen the pandemic’s impacts on global mobility so that air travel, trade and tourism can recover more quickly and bring prosperity back to many hard-hit markets and regions worldwide.

Continuing efforts by States to implement WHO and ICAO recommendations, including those issued by the ICAO Council’s Aviation Recovery Task Force (CART), and adopted in the Ministerial Declaration at ICAO’s High-level Conference on COVID-19, are helping to eliminate travel restrictions disproportionate to public health risks, and to lessen the pandemic’s impacts on global mobility so that air travel, trade and tourism can recover more quickly and bring prosperity back to many hard-hit markets and regions worldwide.

A year of sporadic recoveries

The first quarter of 2021 saw a decrease in the rate of global air traffic recovery due to the sharp spike at that time in COVID-19 infections. The situation stabilized slightly in the second and third quarters, mainly due to rising vaccination rates, and with an accompanying relaxation in travel restrictions in various parts of the world during the peak travel season. This upward trend stalled quickly in the fourth quarter, with the emergence of the Omicron variant.

The impact of the pandemic continues to weigh disproportionately on domestic and international travel, with the former recovering at a faster pace. Overall, domestic passenger traffic has recovered to 68 percent of pre-pandemic levels, while international traffic remains at just 28 percent.

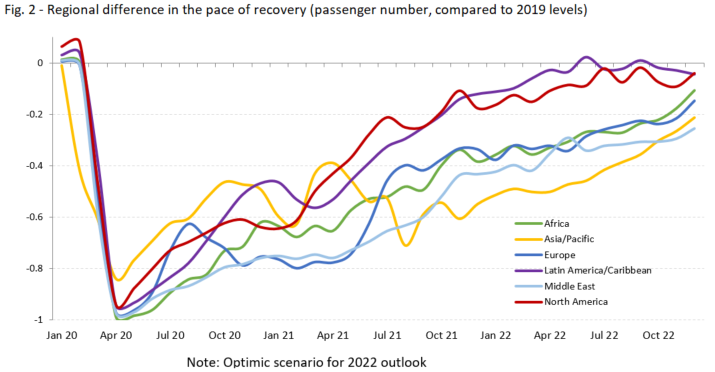

The global aviation recovery has also been characterized by significant regional variation, with the North and Latin America and Caribbean regions showing the highest recovery rates, Europe picking up noticeably during the summer travel season, and Africa and the Middle East recovering moderately, until Africa plunged again due to Omicron restrictions. The Asia/Pacific was the weakest performing region as a result of slowed domestic and stagnant international traffic levels (see Fig.2).

The global aviation recovery has also been characterized by significant regional variation, with the North and Latin America and Caribbean regions showing the highest recovery rates, Europe picking up noticeably during the summer travel season, and Africa and the Middle East recovering moderately, until Africa plunged again due to Omicron restrictions. The Asia/Pacific was the weakest performing region as a result of slowed domestic and stagnant international traffic levels (see Fig.2).

Outlook still uncertain

Both positive signs and downside risks confront analysts trying to gauge how the aviation recovery will play out over the remainder of 2022. ICAO currently projects that 2022 passenger totals will be 26 to 31 percent less than pre-pandemic levels, with seat capacity down 20 to 23 percent. In an optimistic scenario, passenger traffic is expected to recover to 86 percent of its 2019 levels by December 2022, based on 73 percent international traffic recovery and 95 percent domestic.

More pessimistic scenarios point to a 75 percent recovery based on 58 percent international and 86 percent domestic recoveries. This projected continued decline in traffic could translate into estimated losses of $186–$217 billion in gross airline passenger operating revenues in 2022 compared to 2019.

ICAO’s longer-term forecasts indicate that current downturns will also affect traffic patterns over the longer term, with the 2018-2050 compound annual growth rate (CAGR) of global revenue passenger kilometres (RPKs) currently projected at 3.6 percent, down from the 4.2 percent forecast pre-COVID.

About the scenario analysis

The scenario outlook is being adjusted regularly to take into account the updated pandemic situation. Analytical structure of the scenarios by Dr. Toru Hasegawa, who is the lead author of the analysis, can be found in the article: “How do you project air passenger traffic and its economic impact during the COVID-19 pandemic?”.