The air transport industry is not only a vital engine of global socio-economic growth, but it is also of vital importance as a catalyst for economic development. Not only does the industry create direct and indirect employment and support tourism and local businesses, but it also stimulates foreign investment and international trade.

Informed decision-making is the foundation upon which successful businesses are built. In a fast-growing industry like aviation, planners and investors require the most comprehensive, up-to-date, and reliable data. ICAO’s aviation data/statistics programme provides accurate, reliable and consistent aviation data so that States, international organizations, aviation industry, tourism and other stakeholders can:

-

- make better projections;

- control costs and risks;

- improve business valuations; and

- benchmark performance.

The UN recognized ICAO as the central agency responsible for the collection, analysis, publication, standardization, improvement and dissemination of statistics pertaining to civil aviation. Because of its status as a UN specialized agency, ICAO remains independent from outside influences and is committed to consistently offering comprehensive and objective data. Every month ICAO produces this Air Transport Monitor, a monthly snapshot and analysis of the economic and aviation indicators.

ECONOMIC DEVELOPMENT – February 2019

World Results and Analyses for December 2018

Total Scheduled Services (Domestic and International)

![]()

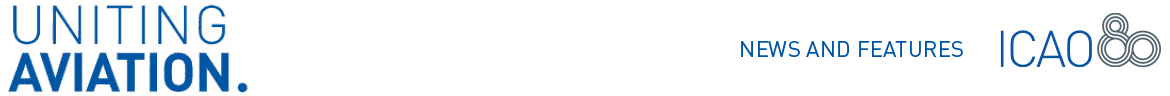

World passenger traffic grew by +5.3% YoY in December 2018, -0.9 percentage point lower than the growth in the previous month. This was the second weakest growth in 2018. Europe, Asia Pacific, and Latin America/Caribbean, in spite of the slowdown, denoted the highest traffic growth in respective order. The Middle East posted the weakest performance among all regions with no growth. Domestic traffic growth remained highest for the second time during the year in the Russian Federation, followed by India and China.

![]()

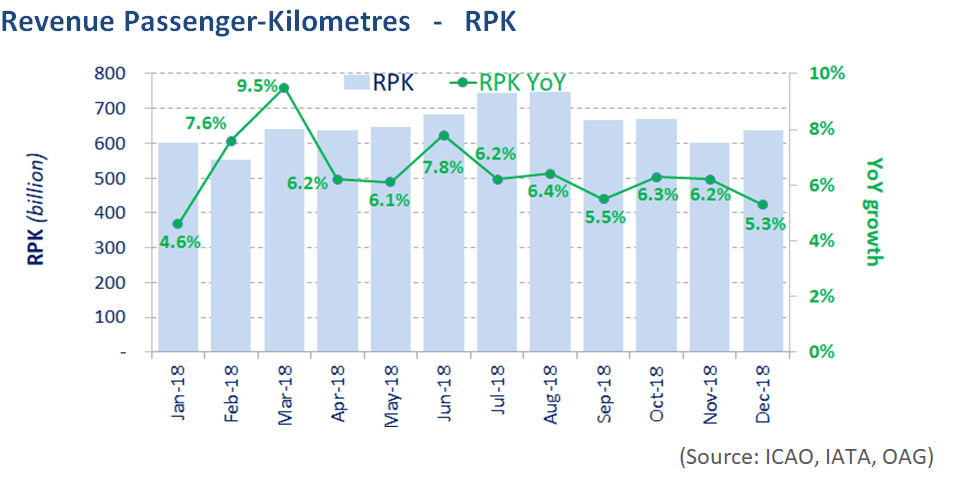

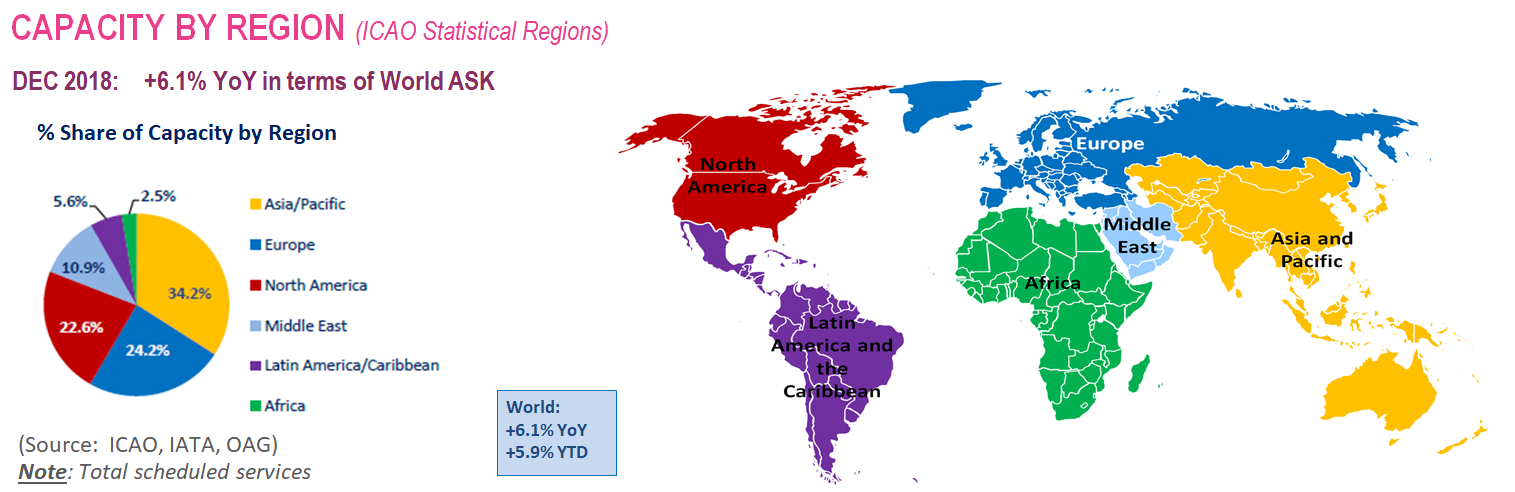

Capacity worldwide increased by +6.1% YoY in December 2018, -0.7 percentage point lower than the growth in the previous month (+6.8%). According to the airline schedules, the expansion of capacity is expected to be at +6.3% in January 2019.

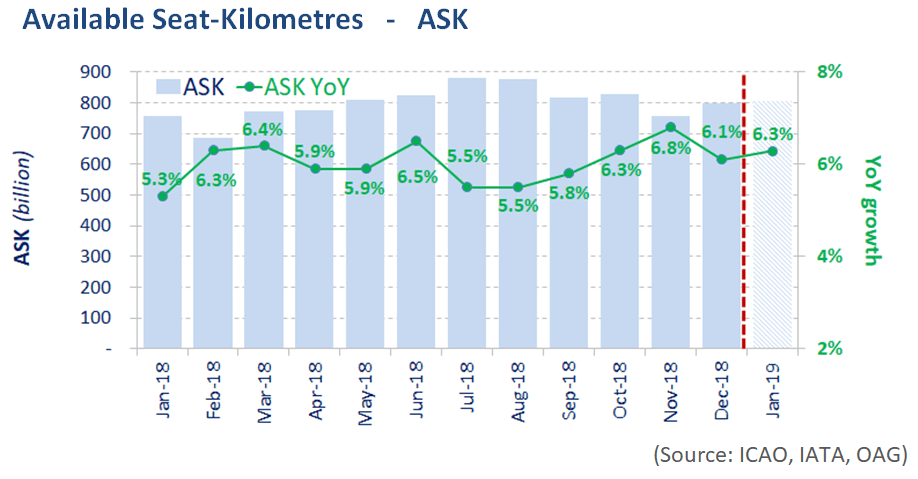

International passenger traffic grew by +5.5% YoY in December 2018, -1.1 percentage points lower than the growth in the previous month. Asia/Pacific and Latin America/Caribbean accelerated in traffic growth. Europe remained the strongest international market albeit, with a slowdown in growth. The growth of international tourist arrivals* followed a similar monthly trend.

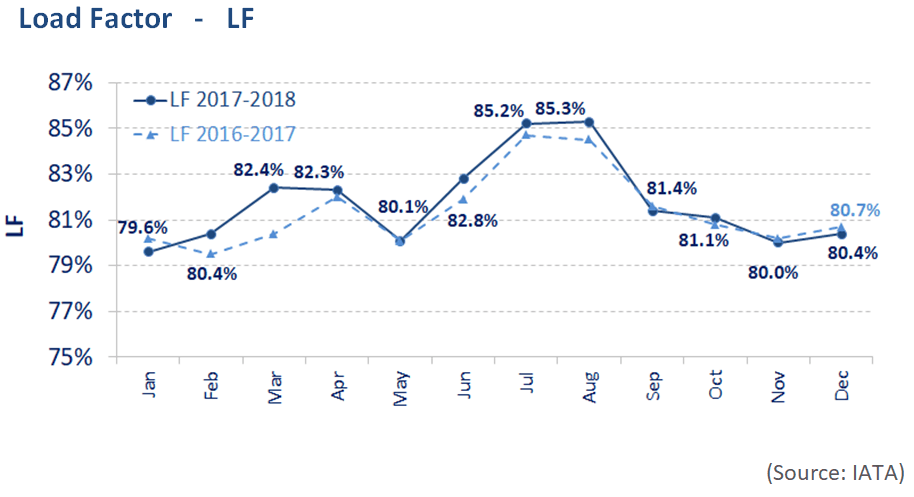

The passenger load factor (LF) reached 80.4% in December 2018, +0.4 percentage point higher than the LF recorded in the previous month. As capacity expansion outpaced the traffic growth, the December LF was -0.3 percentage point lower than the same period in 2017.

![]()

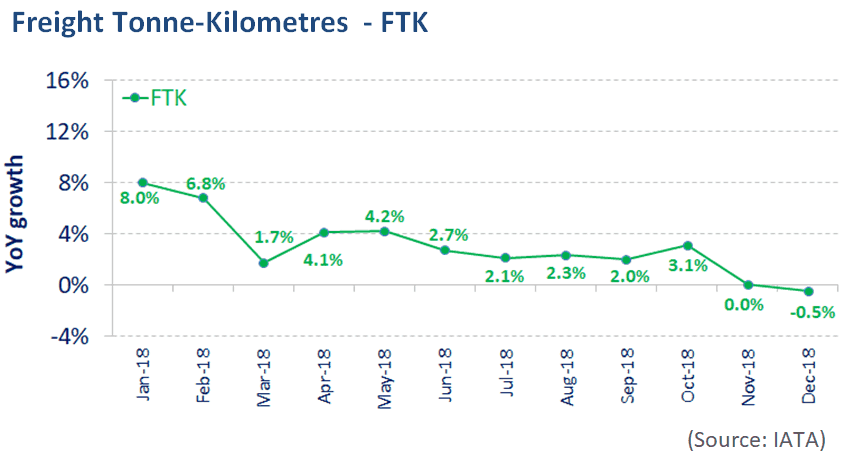

World freight traffic reported a negative growth of -0.5% YoY in December 2018, -0.5 percentage point lower than the growth in the previous month. The slowdown in freight traffic reciprocated softened economic growth impacted by the apprehension concerning Brexit and the on-going US-China trade tensions. All regions, except for Europe and Africa, posted deceleration in growth, with three regions showing negative growth, namely Africa, Asia/Pacific and Latin America/Caribbean. The weakest performance was reported by Asia/Pacific, followed by Africa. North America remained the fastest growing region despite a slowdown in growth. Owing to a slight improvement, Europe became the second fastest growing region.

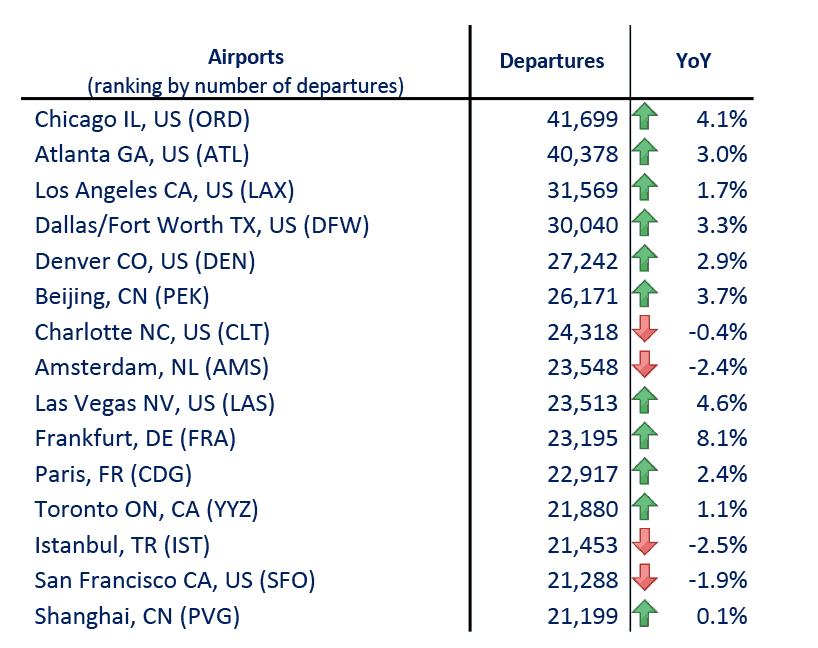

In terms of aircraft departures, the Top 15 airports reported growth of +2.2% YoY. Thirteen out of the Top 15 airports posted YoY increases. Chicago retained the 1st position and grew at +2.4%. The strongest growth in operations was recorded by Denver at +5.0%, followed by Amsterdam at +4.7%.

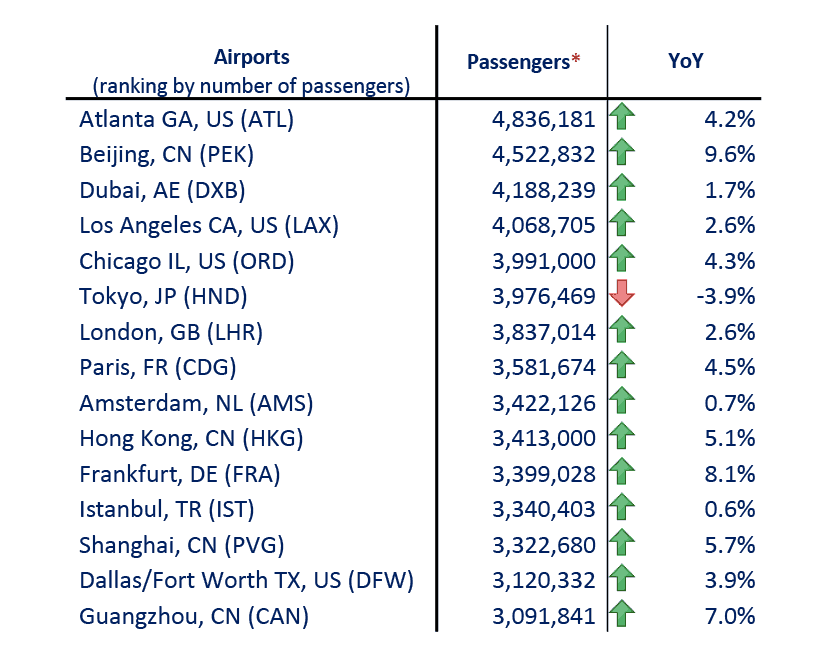

In terms of passengers, the Top 15 airports reported growth of +2.9% YoY. All the Top 15 airports posted YoY increases, except for Tokyo and Dubai with a decline of –1.5% and -1.7%, respectively. Atlanta retained the 1st position and topped the list in terms of YoY increases at +7.2%, followed by Incheon at +6.3%. Beijing remained 2nd with a growth of 3.0%.

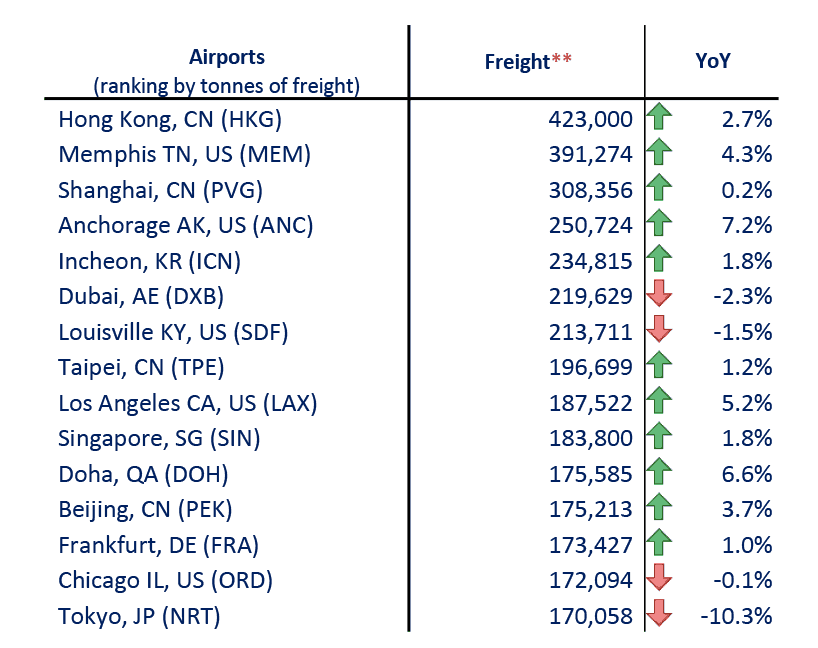

In terms of freight, the Top 15 airports reported a decline of -3.6% YoY. All the Top 15 airports posted YoY decreases, except for Dubai and Doha. The most significant decline was posted by Tokyo (-14.4%), followed by Paris (-7.9%). Doha continued to be the strongest performing airport followed by Dubai growing at +6.8% and +2.3%, respectively.

![]()

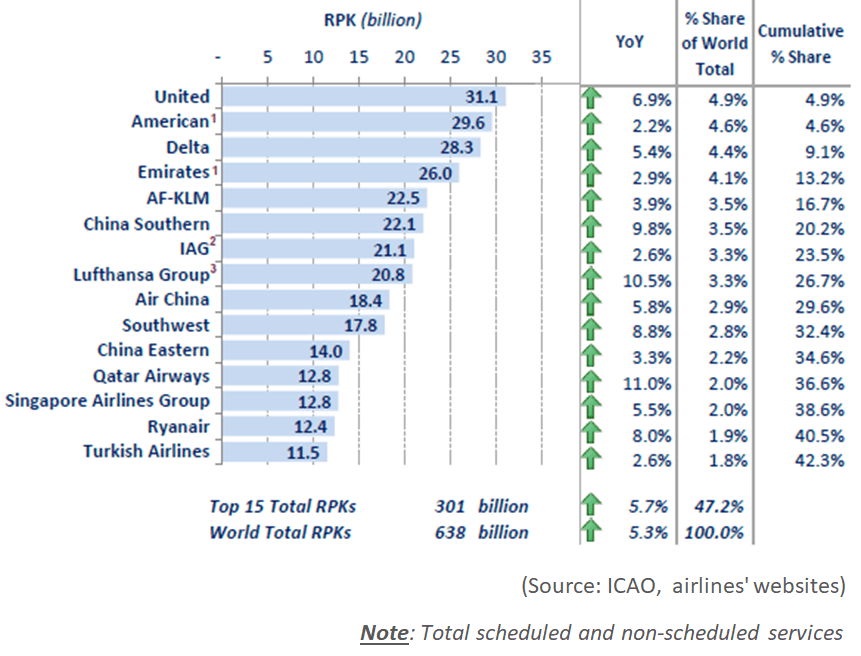

In terms of RPK, the Top 15 airline groups accounted for 47.2% of world total RPK in December 2018 and grew by +5.7% YoY. This growth was +0.4 percentage point higher than the world average on scheduled services. All the Top 15 airline groups posted YoY increases.

United continued to grow with second highest pace among the North American airlines in the Top 15 and retained the 1st position with a +6.9% rise. Following were American and Delta, up +2.2% and +5.4%, respectively. Southwest descended 1 position to 10th despite a +8.8% growth.

Emirates retained the 4th position and rose by +2.9%. Qatar trended upwards by 3 positions at 12th with the highest growth of +11.0%.

AF-KLM grew by +3.9% and maintained the 5th place. Lufthansa recorded the second fastest growth at +10.5%, albeit ranked 2 positions down to 8th. IAG ranked 1 position up at 7th with a soft growth of +2.6%. Ryanair saw a sizeable growth at +8.0% and plummeted to 14th position. Turkish Airlines grew at +2.6% and ranked 1 position down to 15th.

The growth of major airlines in Asia/Pacific continued to be solid. China Southern recorded the third fastest growth at +9.8% and ranked 1 position up to 6th. Singapore Airlines grew at +5.5% and remained at 13th. Air China ascended 1 position while China Eastern maintained its stance, and ranked 9th and 11th with an increase of +5.8% and +3.3%, respectively.

Worldwide capacity expanded by +6.1% YoY in December 2018. All regions posted a slowdown in capacity expansion except Africa, with the most notable deceleration in North America and the Middle East.

Africa recorded the most significant improvement, however, remained as the slowest region in terms of capacity expansion. Europe continued to be the fastest growing region.